IRS Instruction W-8BEN 2021-2025 free printable template

Show details

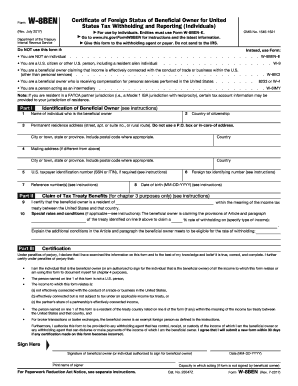

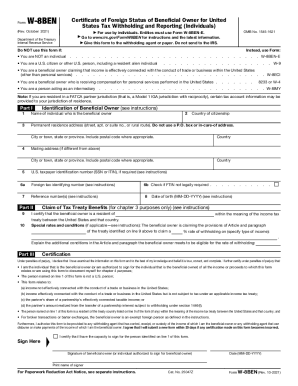

Instructions for Form W8BENDepartment of the Treasury Internal Revenue Service(Rev. October 2021)Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign w 8ben instructions form

Edit your form w8 usa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w 8ben for non us individuals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the w 8ben online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit w 8ben form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction W-8BEN Form Versions

Version

Form Popularity

Fillable & printabley

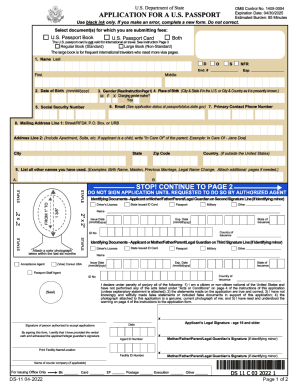

How to fill out pdffiller form

How to fill out IRS Instruction W-8BEN

01

Obtain the IRS Form W-8BEN from the IRS website or your financial institution.

02

Fill out your name in Line 1.

03

Fill in your country of citizenship in Line 2.

04

Provide your permanent address in Line 3, including city, state, and postal code.

05

Fill in your mailing address in Line 4 if it's different from your permanent address.

06

Enter your U.S. taxpayer identification number (if applicable) in Line 5.

07

Provide your foreign tax identification number in Line 6, if applicable.

08

Indicate your date of birth in Line 7 using the MM/DD/YYYY format.

09

In Part II, indicate the type of income you are claiming a reduced rate on under a tax treaty, if applicable.

10

Sign and date the form at the bottom, confirming that the information provided is true and correct.

Who needs IRS Instruction W-8BEN?

01

Individuals who are non-U.S. residents receiving certain types of income from U.S. sources.

02

Foreign entities or organizations that are engaged in trade or business in the United States.

03

Anyone claiming a reduced withholding tax rate on income that is eligible under U.S. tax treaties.

Fill

w 8ben form

: Try Risk Free

People Also Ask about w 8ben e

What is the difference between a w8 and w9 tax form?

A W-9 tax form is for US residents or citizens and is used to confirm your tax ID number (TIN). A W-8 tax form is for non-US residents and is used to confirm that you are not a US taxpayer. These forms help us to file your 1099 tax forms.

Who fills out w9 vs w8?

The Main Differences FormWho fills out the formWhen to submitW-9Independent contractors/freelancers that are US citizensAfter onboarding or after updating address, TIN, or business nameW-8Non-US citizens working as independent contractors/ freelancersBefore the first payment is made Jan 1, 2023

Who is responsible for filling out a w9?

Those who should fill out a W 9 are those who are working as independent contractors or freelancers, because the W-9 is the form used by the IRS to help gather information about such workers. The W-9 form is an informational reporting tax form, meaning that it provides information to the IRS about taxable entities.

What is the w8 form used for?

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes.

Who is required to fill out a w8?

Who Can File W-8 Forms? W-8 forms are filled out by foreign individuals or entities that lack U.S. citizenship or residency, but have worked in the U.S. or earned income in the U.S. This usually applies to foreign-domiciled businesses and non-resident aliens.

Who fills out a w8?

Who Can File W-8 Forms? W-8 forms are filled out by foreign individuals or entities that lack U.S. citizenship or residency, but have worked in the U.S. or earned income in the U.S. This usually applies to foreign-domiciled businesses and non-resident aliens.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in w8ben without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your irs form w 8ben, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my w 8ben instructions pdf in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your how to w 8ben and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit w 8ben e instructions on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit w8 ben.

What is IRS Instruction W-8BEN?

IRS Instruction W-8BEN is a tax form used by foreign individuals and entities to certify their foreign status and claim the benefits of any tax treaty provisions. It helps establish that the payee is not a U.S. person and provides necessary information to avoid or reduce withholding taxes on income earned from U.S. sources.

Who is required to file IRS Instruction W-8BEN?

Foreign individuals and entities receiving income from U.S. sources that are subject to withholding tax are required to file IRS Instruction W-8BEN. This includes non-resident aliens, foreign corporations, partnerships, and certain other foreign entities.

How to fill out IRS Instruction W-8BEN?

To fill out IRS Instruction W-8BEN, ensure to provide your name, country of citizenship, and your foreign address. You must also provide your U.S. taxpayer identification number (TIN) if you have one, and any applicable tax treaty information. Follow the instructions carefully to avoid errors.

What is the purpose of IRS Instruction W-8BEN?

The purpose of IRS Instruction W-8BEN is to document foreign status for U.S. tax purposes and to claim a reduction or exemption from withholding tax under an applicable tax treaty between the foreign individual/entity's home country and the United States.

What information must be reported on IRS Instruction W-8BEN?

The information that must be reported on IRS Instruction W-8BEN includes the name of the beneficial owner, country of citizenship, permanent address, mailing address, taxpayer identification number, and specific claims for tax treaty benefits, if applicable.

Fill out your IRS Instruction W-8BEN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form W 8ben Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to irs form w 8ben instructions 2025 pdf

Related to form w8ben

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.